After a trading update revealed a 20% drop in Q3 revenue, ITV (LSE: ITV) shares fell 15% earlier this week. Is that a cause for concern — or does the 8% dividend yield still make the shares attractive?

I’m taking a closer look.

In a trading update released Thursday (7 November), the broadcaster reported varied financial results for the first nine months of 2024. Its ITV Studios arm saw a 20% drop in revenue, impacted by the US writers’ and actors’ strike.

Should you invest £1,000 in ITV right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ITV made the list?

Group revenue was down 8% at £2.74bn against £2.97bn in 2023, with a decline in ITV Studios revenue offsetting growth in total advertising revenue (TAR).

However, the broadcaster says it’s still on track to achieve record profits by year-end. Chief executive Carolyn McCall said: “Our cost-saving programme is progressing well and today we are announcing further cost savings in addition to the previously announced £40 million of incremental cost savings through restructuring, improved efficiency and simplifying ways of working.“

By contrast, its ITVX streaming platform displayed solid growth, with streaming hours rising 14% and digital advertising revenue increasing 15%. To further enhance profitability, the company has also outlined an additional £20m in cost savings.

Business developments

ITV Studios recently acquired a majority stake in prominent UK drama producer Eagle Eye and secured the option to adapt Philippa Gregory’s novel Wideacre for television. Both developments should be good for business.

It also lined up a range of new dramas for ITVX. Examples include the thriller Playing Nice, with James Norton, plus the current crime drama Joan, and real-life thriller Until I Kill You.

Long-time favourites like Dancing on Ice, Celebrity Big Brother and Deal or No Deal continue to appeal to broad audiences across its main ITV1 channel and ITVX

Dividend track record

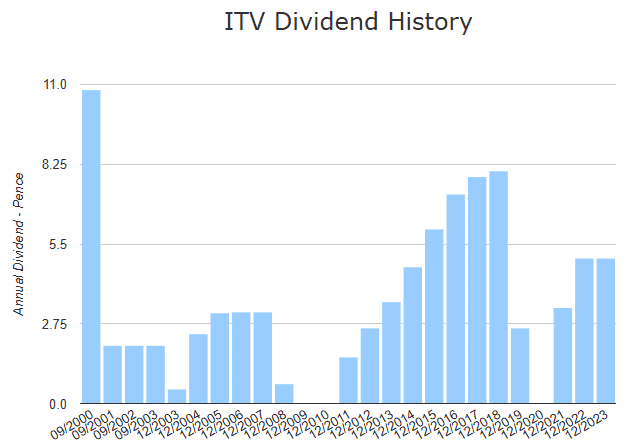

One of my main concerns regarding ITV in terms of dividends is a sketchy payment track record. When the economy is good — like between 2011 and 2018 — dividends are reliable. But when it’s not, the broadcaster is quick to make cuts and reductions.

Following the 2008 crisis, dividends were cut completely for two years and in 2020 they were cut again. While this doesn’t negate the decent returns delivered in other years, it’s not exactly reliable in terms of passive income.

Dividend cuts can scare off investors and hurt the share price, which could lead to losses.

To avoid cuts, it must successfully capture streaming audiences and generate sufficient revenue from digital content. This could be challenging, as it faces fierce competition from major players like Netflix, Amazon Prime and Disney+.

My verdict

The fall in revenue’s a concern but I think several factors make ITV still appear attractive. Not least of which is a low forward price-to-earnings (P/E) ratio of 7.6. It also has a decent net profit margin of 12.11% and a low debt-to-equity ratio of 39.5%.

Even though my current shares are a bit down today, I plan to take advantage of this opportunity and buy more while they’re cheap!